Frequently Asked Questions

Everything in a rowFrequently Asked Questions

General Data Protection Regulation (GDPR)

go2UBL considers your privacy important and we want to provide transparency about the data we process and how we use it.

Since go2UBL processes a lot of personal data every year for the provision of its services, a privacy policy is a necessary requirement. In this policy you will find the general principles regarding the processing of personal data and the way in which go2UBL B.V. treated these.

On request we provide our processing agreement which you must return signed.

Guarantee:

go2UBL protects your personal data. We have never sold that information to third parties and we never will.

Since go2UBL processes a lot of personal data every year for the provision of its services, a privacy policy is a necessary requirement. In this policy you will find the general principles regarding the processing of personal data and the way in which go2UBL B.V. treated these.

On request we provide our processing agreement which you must return signed.

Guarantee:

go2UBL protects your personal data. We have never sold that information to third parties and we never will.

What are the costs?

We use various rates to convert purchase and sales documents to a UBL + PDF. This depends on the type of document, which elements must be supplied and the quality of the document.

You can find an extensive overview of the costs on the rates page.

If a document is not a purchase or sales document, we will reject the first 25 documents per administration per month with a return reason, free of charge. Double supplied purchase or sales documents rejected with the reason: "double delivered" are calculated.

No implementation or subscription costs are charged for joining go2UBL. There is also no maintenance contract or mandatory minimum purchase.

You can find an extensive overview of the costs on the rates page.

If a document is not a purchase or sales document, we will reject the first 25 documents per administration per month with a return reason, free of charge. Double supplied purchase or sales documents rejected with the reason: "double delivered" are calculated.

No implementation or subscription costs are charged for joining go2UBL. There is also no maintenance contract or mandatory minimum purchase.

What is line recognition?

The universal line recognition is a very valuable addition to our conversion service and is available within the go2UBL platform.

During recognition, the following is recognized at line level:

- Item number - Description - Quantity - Unit price - VAT.

These rules with the elements mentioned are included in the UBL. It is important that the document (if it is delivered scanned) has a resolution of at least 150 DPI. Logically, the original PDF is preferred to avoid quality loss during scan-and-recognition.

During recognition, the following is recognized at line level:

- Item number - Description - Quantity - Unit price - VAT.

These rules with the elements mentioned are included in the UBL. It is important that the document (if it is delivered scanned) has a resolution of at least 150 DPI. Logically, the original PDF is preferred to avoid quality loss during scan-and-recognition.

What kind of purchasing documents can be supplied?

The following purchasing documents can be supplied:

- Standard purchase invoices

- Credit notes

- Cash and pin receipts

- Purchasing statements

- Invoices (from employees)

- Tax assessments

- Foreign invoices

- Invoices without a Chamber of Commerce number

- Self-billing standard invoice

-Self-billing credit note

-Self-billing foreign invoice

- Standard purchase invoices

- Credit notes

- Cash and pin receipts

- Purchasing statements

- Invoices (from employees)

- Tax assessments

- Foreign invoices

- Invoices without a Chamber of Commerce number

- Self-billing standard invoice

-Self-billing credit note

-Self-billing foreign invoice

What kind of sales documents can be supplied

The following sales documents can be submitted:

The format of the sales invoices can be:

go2UBL is also able to recognize an invoice text required by you. Please contact us for this.

- (Credit) Sales Invoices B2B

- (Credit) Sales Invoices to individuals

- Sales invoices within the EU

- Sales invoices outside the EU

The format of the sales invoices can be:

- MS Word

- MS Excel

go2UBL is also able to recognize an invoice text required by you. Please contact us for this.

Where are the UBL files delivered?

After go2UBL has converted the purchase documents, they are delivered to the agreed location. That can be:

- FTP server

- Dropbox

- Google Drive

- OneDrive

- Email address (possibly linked to accounting software)

- Exact Online

- Cash Software

- API

Can I supply formats other than PDF?

Yes. All kinds of graphic formats and MS Word and MS Excel are supported and automatically converted to UBL format, so that they can be imported in any UBL-ready software package. You will also receive the document in PDF.

Do I receive a notification if a document is not processed for any reason?

Yes, you will receive an email explaining why a document cannot be processed. The following reasons are possible:

- Invoice does not meet the invoice requirements

- Document is illegible

- Document is not a purchasing document (for example a packing slip, order confirmation, order, reminder, etc.)

- Multiple purchasing documents delivered on 1 page

- Document is a picture, logo or signature

Can I deliver multiple documents in 1 scan?

It is desirable to provide each document separately. Most scanners are able to generate a file per page. If you want to deliver per batch, we have the option to split it. To use this feature, send an email to support: support@go2ubl.com.

How long does it take before I receive my submitted purchasing documents as an e-invoice?

As soon as the documents are submitted, an attempt is made to automatically fill in all essential fields. This usually works, but it is also often the case that not all elements can be found properly. In that case, go2UBL manually adds the missing elements. In this way, a UBL is always generated. So also of the most illegible or handwritten documents.

If invoices have to be processed at line level, the average time is about 1 hour with a maximum of 72 hours.

The average processing time of standard invoices is generally 1 hour. It's only a few minutes from automatically recognized documents.

If invoices have to be processed at line level, the average time is about 1 hour with a maximum of 72 hours.

The average processing time of standard invoices is generally 1 hour. It's only a few minutes from automatically recognized documents.

Is go2UBL a scan-and-recognize solution?

Partly. go2UBL also uses scan-and-recognize technology, but as an aid. The fact is that such techniques often do not go beyond 80% recognition, not to mention correctness. We strive for 100% recognition and 100% accuracy.

With scan-and-recognize solutions, the recipient often has to take additional actions to get a document booked. For example, naming fields or teaching the system how the invoice layout works. go2UBL does this for you and always supplies a complete UBL file including the NAW data known to the Chamber of Commerce.

No requirements are set for the quality of how documents are delivered to us. If these are upside down or hard to read, they can be processed. Only if the human eye can no longer perceive the content, will the document be rejected as illegible.

With scan-and-recognize solutions, the recipient often has to take additional actions to get a document booked. For example, naming fields or teaching the system how the invoice layout works. go2UBL does this for you and always supplies a complete UBL file including the NAW data known to the Chamber of Commerce.

No requirements are set for the quality of how documents are delivered to us. If these are upside down or hard to read, they can be processed. Only if the human eye can no longer perceive the content, will the document be rejected as illegible.

Why is the credit limit or payment discount not taken into account in the UBL file?

go2UBL ignores credit restriction or payment discount which is stated on the invoice. This was deliberately chosen because this discount may only be applied if the conditions are actually met. That cannot be assessed for go2UBL. The discount can therefore be "debited" by the ultimate processor after payment. Incidentally, this is also the correct approach from an accounting perspective.

Can I throw away my bills and receipts?

The correct answer to this question cannot be given due to lack of clarity from the government. The Dutch national government has published a publication here and states:

Yes, the brochure 'Your computerized administration and the tax retention obligation' of the Tax Authorities explains that you can throw away scanned invoices under certain conditions.

However, when you read through this brochure, it does not appear that you can throw away the "source documents".

Please ask the national government for exact regulations

Yes, the brochure 'Your computerized administration and the tax retention obligation' of the Tax Authorities explains that you can throw away scanned invoices under certain conditions.

However, when you read through this brochure, it does not appear that you can throw away the "source documents".

Please ask the national government for exact regulations

Delivery by e-mail

When submitting documents by e-mail to go2UBL, you can insert up to 15 MB of documents as an attachment with a maximum of 20 documents as an attachment.

A document must be sent as an attachment for each invoice. So: multiple documents as an attachment are possible. Multiple invoices in one document is not possible.

If you want to submit more than 20 documents to us at the same time, it is advisable to use the "Drag en Drop" function on the customer card.

A document must be sent as an attachment for each invoice. So: multiple documents as an attachment are possible. Multiple invoices in one document is not possible.

If you want to submit more than 20 documents to us at the same time, it is advisable to use the "Drag en Drop" function on the customer card.

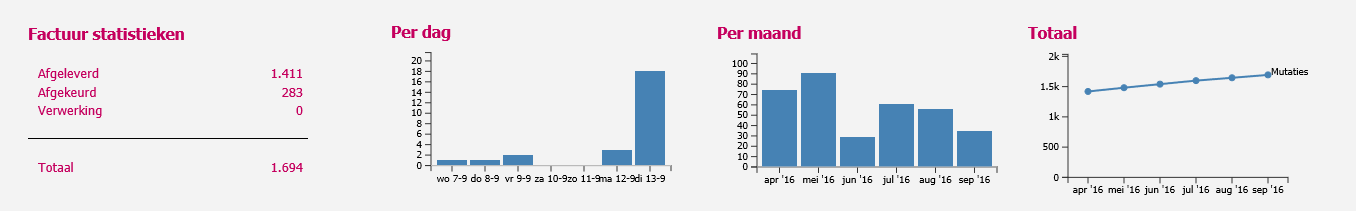

Can I see how many documents are processed, rejected and in progress?

Yes, when you log in to go2UBL you can see the progress and history of the processing for one or more companies.

Which date is recognized? Invoice date or due date?

The original invoice date will be included in the UBL. When processing sales invoices (convert2UBL), it is possible to receive the due date as an extra addition. For this you need to check this on the convert2UBL tab of your administration.

Can go2UBL recognize multiple VAT rates?

go2UBL is able to recognize VAT bases and rates. In the UBL, a split is therefore made at 0%, VAT low, VAT standard, VAT high and bases.

Example: if you send in a pin receipt with fuel and a sandwich, the UBL will consist of 2 lines: VAT high and VAT low.

Example: if you send in a pin receipt with fuel and a sandwich, the UBL will consist of 2 lines: VAT high and VAT low.

I also want to convert my sales invoices to UBL and read them into my accounting package. Is that possible?

Via convert2UBL we make it possible to convert your sales invoices into a UBL file. This file can then be read in your accounting package if it offers the possibility to read sales invoices.

The procedure is the same: email your sales documents to <yourCoCnumber>@convert2UBL.nl.

The vision of many accounting packages is that you can create the invoices in “their” package and then an import facility is not necessary. Practice is clearly different: many entrepreneurs make their incoices in Microsoft Excel or Word or an unrelated billing package.

For more information about convert2UBL you can contact us.

The procedure is the same: email your sales documents to <yourCoCnumber>

The vision of many accounting packages is that you can create the invoices in “their” package and then an import facility is not necessary. Practice is clearly different: many entrepreneurs make their incoices in Microsoft Excel or Word or an unrelated billing package.

For more information about convert2UBL you can contact us.

Where are my invoices processed?

go2UBL processes a large part of the invoices automatically using advanced (OCR) scan-and-recognize techniques with extensive quality controls. In addition to the guarantee of a 100% full UBL, the accuracy of our output is more than 95%. In order to get and keep the quality at the highest possible level, continuous adjustment of “human” is necessary. As described earlier in this article “robot is good, but humans are better” humans are better able to post invoices than robots. Human correction and supplementation takes plase in various places:

– In the Netherlands

– Within the EU

– Outside the EU

We do this for you to ensure that the turnaruond times remain short even outside normal office hours and of course we try to keep costs under control. All audit procedures that are performed will always be performed by qualified employees in the Netherlands. Documents with an increased correctness quarantee can therefore have a longer turnaround time outside office hours. After all, we find correctness very important, of course we do not lose sight of timeliness.

– In the Netherlands

– Within the EU

– Outside the EU

We do this for you to ensure that the turnaruond times remain short even outside normal office hours and of course we try to keep costs under control. All audit procedures that are performed will always be performed by qualified employees in the Netherlands. Documents with an increased correctness quarantee can therefore have a longer turnaround time outside office hours. After all, we find correctness very important, of course we do not lose sight of timeliness.

I am in an industry where invoices may not be processed outside my country. Can go2UBL guarantee that?

go2UBL considers it important that you are “in control” where your invoices can be processed. In addition to your own wishes, we are als bound by laws and regulations to be transparent where your invoices can be processed. That is why go2UBL offers the possibility that you can get certainly where your invoices may be processed:

– In the Netherlands

– Within the EU

– Worldwide

– In the Netherlands

– Within the EU

– Worldwide

Recognition of 0% VAT and Margin scheme

go2UBL recognizes the VAT bases and the applicable percentages. If no VAT is mentioned on the invoice, the entire amount will be treated as the basis of 0% VAT. No allowance is made for any Margin scheme.

Delivery setting FTP

go2UBL provides the ability to deliver the converted documents to an FTP location. In many cases, for security reasons, it is decided to whitelist the sender.

Since it is less maintenance sensitive, go2UBL has made the sending IP numbers available through the host name delivery.go2ubl.nl.

Because it is known that not everyone can configure a host name with multiple IP numbers. we have also made 5 host names available with only one IP number.

These are the host names:

Since it is less maintenance sensitive, go2UBL has made the sending IP numbers available through the host name delivery.go2ubl.nl.

Because it is known that not everyone can configure a host name with multiple IP numbers. we have also made 5 host names available with only one IP number.

These are the host names:

- delivery001.go2ubl.nl

- delivery002.go2ubl.nl

- delivery003.go2ubl.nl

- delivery004.go2ubl.nl

- delivery005.go2ubl.nl

- go to the commandline

- type in nslookup

- type in delivery.go2ubl.nl

- You will see the IP numbers from which we send files to your FTP server.

Order number recognition

At the request of various enthusiastic customers, who use various ERP systems, go2UBL has made it possible to recognize the order number on the invoice.

You can use this option by default. Mail your purchasing documents WITH order number to <yourCoCnumber>@logistics2UBL.nl. The output (PDF + UBL) is currently delivered to an email address that you set at customer level. We are currently working on multiple delivery options.

You can use this option by default. Mail your purchasing documents WITH order number to <yourCoCnumber>